I usually write about healing and awakening, so you might wonder why I am discussing this topic. To me, financial well-being is an essential part of life and should not be overlooked. As both an entrepreneur in the investment world and a person committed to spiritual growth, I believe that true wealth encompasses both material security and inner fulfillment.

There are different reasons why we invest: saving for retirement, generating capital gains in order to become wealthy, creating a regular income to live from—and storing wealth safely for us and our children.

In this article, I want to focus on wealth preservation and why I believe the two best assets for this purpose are gold and Bitcoin. While gold has been trusted for centuries and is widely recognized, Bitcoin emerged only in 2008, initially attracting a niche group of enthusiasts and tech innovators. However, this is changing rapidly. Bitcoin is going mainstream, with countries, corporations, and Wall Street increasingly embracing it as a legitimate financial asset.

And while many people debate in online forums about whether gold or Bitcoin is the better store of value, I firmly believe that everyone should hold both!

Our financial system is a scam

Throughout history, financial systems have followed cycles of collapse and restructuring, often triggered by major political events and wars. However, for the longest periods, money was backed by hard assets like gold, preventing governments from endlessly devaluing currency and stealing wealth from their citizens.

This changed fundamentally with the introduction of the Bretton Woods System in 1944, where the U.S. dollar remained gold-backed, while other currencies were pegged to it. In 1971, Richard Nixon ended dollar convertibility to gold, effectively dismantling the gold standard worldwide. The shift to a fully fiat system was completed when the U.S. abandoned fixed exchange rates and in 1976, gold was officially removed from the IMF’s definition of money.

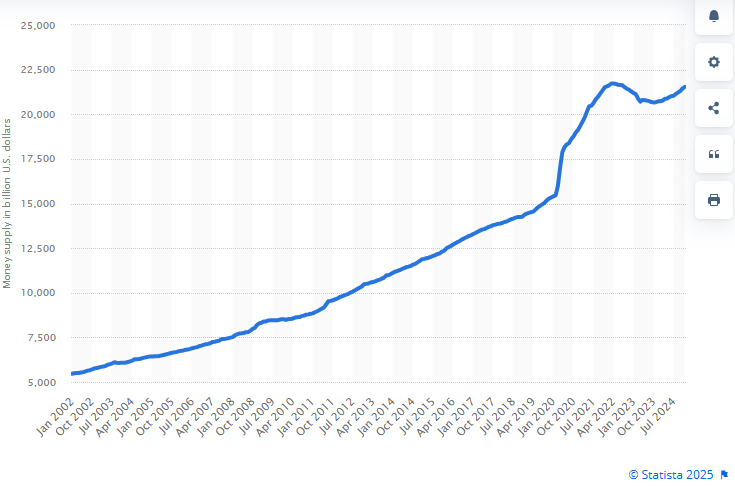

Today, money is created out of thin air, with central banks printing at will, endlessly expanding the money supply. The following chart illustrates the explosive growth of the U.S. M2 money supply from 2002 to 2024, soaring from USD 5 trillion to over USD 20 trillion!

Other countries are in even worse shape. This means our currencies are constantly being devalued and are losing purchasing power against real assets. In other words, our money buys less and less, and we are getting poorer every day.

So what can we do?

In my view, everyone should own real assets that appreciate against fiat money—such as real estate, stocks, precious metals and Bitcoin. Not everyone can afford a home, and even if they do, it is often financed by a bank, meaning the bank technically owns it. Stocks allow individuals to invest with smaller amounts, making them an essential part of any portfolio. However, stock investing requires time and research, and since they are held on external exchanges, they can theoretically be seized or restricted.

There are two assets which are divisible, affordable, and portable—gold (coins) and Bitcoin. Both can be stored at home and taken anywhere, offering true financial sovereignty. For this reason, I believe everyone should own them as part of a well-balanced portfolio.

Why everyone should own gold

Gold has been valued by civilizations for thousands of years, dating back to the ancient Egyptians, Sumerians and Chinese dynasties. It was used for jewelry, religious artifacts and as a store of wealth. During the Roman Empire, gold coins became widespread, strengthening its role in trade and finance.

Over the centuries, gold-backed currencies emerged, leading to the gold standard in the early 20th century, where paper money was directly convertible to gold. However, as mentioned earlier, the gold standard has ended in the 1970s, making fiat currencies the global norm.

Despite this, gold remains a highly sought-after asset for the following reasons:

Store of Value – Gold retains its purchasing power over time, making it a hedge against inflation and currency devaluation.

Safe-Haven Asset – In times of economic instability, war, or financial crises, gold can be stored outside the system and is portable.

Wealth Preservation – Unlike paper currencies, which can be devalued by governments, gold has maintained its worth for millennia.

Portfolio Diversification – Investors hold gold to balance risk, as it often moves independently of stock markets.

Scarcity and Demand – Gold is rare and mining it is costly, which keeps its value high compared to fiat money that can be printed indefinitely.

The following chart shows the price development of one ounce of gold since 1974, demonstrating why gold is a strong hedge against money printing by central banks.

While some argue that gold is not a productive asset and doesn’t belong in a portfolio, I completely disagree—and for obvious reasons. Just look at its price development over time!

Bitcoin is digital gold

Bitcoin was introduced in 2008 by Satoshi Nakamoto through a whitepaper outlining a peer-to-peer electronic cash system. It launched in 2009, with Nakamoto mining the first block (Genesis Block), embedding a message referencing the 2008 financial crisis. Bitcoin’s key innovations include blockchain technology, proof-of-work security and a fixed supply of 21 million coins. Nakamoto disappeared in 2010, leaving behind an untouched fortune of 1 million Bitcoins, and he remains anonymous to this day.

The cap at 21 million makes Bitcoin non-inflationary, unlike fiat money. It is fungible, permissionless, decentralized, and through its advanced encryption it is one of the most secure systems ever designed.

Once dismissed as a niche tool for anarchists and tech enthusiasts, Bitcoin has grown exponentially over the years. 2024 marked a turning point in adoption, with nation-states exploring Bitcoin reserves, corporations using it as a treasury asset, and financial firms like BlackRock launching Bitcoin-based products. In other words, Bitcoin is here to stay!

Bitcoin’s price in USD has been and will remain highly volatile, which can be scary for some. However, when you zoom out and look at the bigger picture, the trend is undeniable—Bitcoin has consistently appreciated in value, outpacing even gold.

For all these reasons, I strongly believe that everyone should own Bitcoin alongside gold. How much? That is a decision only you can make, based on your own financial goals.

My personal portfolio

I personally hold Swiss-based gold ETFs backed by real gold, as well as gold coins. I consistently buy more gold each quarter and have no intention of ever selling it.

For some time now, I have also owned Bitcoin. I initially bought and held it on an exchange until I realized that its true power lies in self-custody. Today, I keep a small portion on a Swiss exchange, while the majority is stored on various hardware wallets, fully disconnected from the financial system.

To me, there is no reason to choose one over the other. Gold and Bitcoin share key qualities yet remain fundamentally different. Both protect against currency debasement and serve as secure stores of value in times of crisis. Most importantly, I can take them with me if I ever need to leave the country.

I strongly encourage everyone to do their own research and, hopefully, disconnect at least part of their wealth from our fraudulent financial system!

Want to engage?

Please subscribe and join my community, if you would like to engage in deeper discussions about this or any topic related to healing and awakening. My paid subscribers have access to personal coaching via Chat, and Gold Members get one hour of personal coaching via Teams/Zoom per year on top.

I also offer personalized coaching sessions on spiritual topics and powerful techniques that have helped me and many others before—let them be a resource for you as well on your path of healing and awakening. Just reach out!

The Path of Healing and Awakening is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.